Beyond the POS:The Case for Integrated Payments in Event Management

You’re a busy restaurateur. You’ve invested thousands in a modern Point of Sale (POS) system. It runs your floor, manages your tabs, and—most importantly—it takes payments. Everything seems to work seamlessly.

So when your event management platform suggests adopting integrated payments, like Tripleseat PartyPay, your first thought might be: “Why would I pay for something my POS already does?”

It feels redundant—a solution in search of a problem.

But here’s the truth: your POS is built for immediate, transactional payments. Your event platform is built for complex, relationship-driven workflows that unfold over weeks or months. That’s where integrated payments in event management become essential.

Using your POS for event payments isn’t saving you money—it’s costing you time, accuracy, and customer satisfaction.

The Critical Difference: A Transaction vs. a Workflow in Event Payments

Think about what your POS is truly designed for. It excels at transactions:

- The Job: Take a payment right now for goods and services just rendered.

- Examples: Closing out a dinner check, running a bar tab, or selling a gift card.

- The Process: It’s one-and-done. A guest swipes, taps, or dips their card, and the transaction is over in seconds. It’s fast, simple, and transactional.

Now, think about the lifecycle of a private event. It’s not a transaction; it’s a workflow:

- The Job: Secure and manage revenue for a complex, customized service that will be delivered weeks or months in the future, almost always in multiple stages.

- The Process: This is a multi-step journey, not a single tap.

- You send a proposal.

- The client accepts.

- You send a contract for an electronic signature.

- At the same time, you need to collect a deposit to secure the date.

- 30 days later, you need to collect a scheduled second payment.

- One week before the event, you collect the final headcount and the final balance.

- After the event, you need to add final “day-of” charges (like open bar overages or extra staff hours) and close out the bill.

Your POS was simply not built to handle this multi-month, multi-payment journey.

The Hidden Costs of Using Your POS for Event Management

When you try to force your POS to do a job it wasn’t designed for, you create hidden costs and massive headaches for your team.

1. The “Spreadsheet & Sticky Note” Nightmare

You take the initial deposit on the POS. Great. Now, how do you track it? You create a spreadsheet. You send an email to your event manager. You put a note in the BEO. Suddenly, the most important piece of information—how much the client has paid—lives in three different places, none of which talk to each other.

- The Risk: A busy manager forgets to update the spreadsheet. The final bill is wrong. You’ve either double-charged an angry client or, worse, under-charged them and lost thousands of dollars.

2. The “Call Me With Your Card” Security Risk

Your POS isn’t built to securely save a credit card for a future payment in three months. So what happens? Your team is forced into risky, unprofessional workarounds. You either write the credit card number on a piece of paper (a huge PCI compliance violation) or you’re forced to call the client every single time a payment is due. This friction makes your client feel like they’re being hounded, and it makes your business look disorganized.

3. The “Final Bill Scramble”

The event is over. The client is happy and ready to leave. Now, your manager has to manually…

- Pull the original BEO.

- Dig through POS records from three months ago to find the deposit.

- Search their email for confirmation of the second payment.

- Subtract both from the event total.

- Manually add the 20% gratuity and 8% tax.

- Ring it all up as one giant, confusing line item in your POS.

This process is slow, incredibly prone to costly math errors, and the final receipt you give the client looks like a jumbled mess, not a professional, itemized invoice.

How Integrated Payments Streamline Event Management Workflows

This is where a dedicated event payment system like Tripleseat PartyPay becomes essential to your restaurant billing infrastructure. It’s not a redundant system; it’s the workflow system that connects everything.

Benefit 1: You Get One Source of Truth

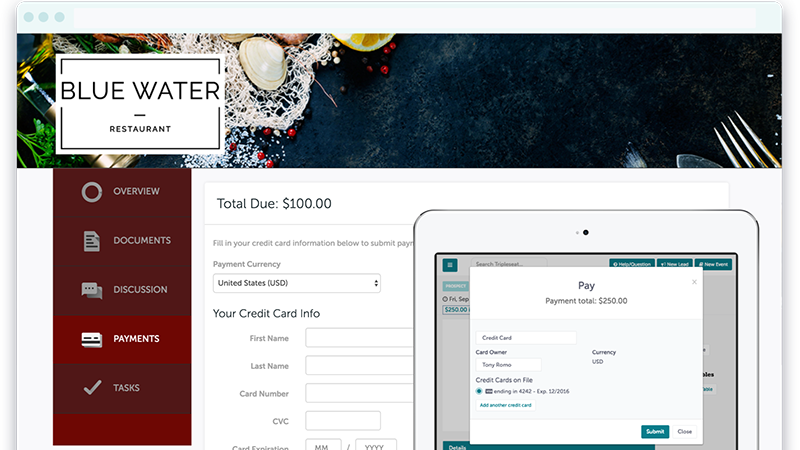

With an integrated system, the platform connects the proposal, the contract, the BEO, and the payments. When a client e-signs their contract in Tripleseat, PartyPay automatically prompts them for the deposit. The event record is instantly updated to “Contract Signed” and “Deposit Paid.” There’s no spreadsheet, no guesswork. Your entire team sees the same, real-time information.

Benefit 2: You Automate Collections and Get Paid on Time

Stop being a bill collector. PartyPay allows you to securely (and PCI-compliantly) capture a credit card once at the beginning. You can then set up automatic payment schedules. The system will automatically charge the card on file for the second and third installments and send automated email reminders before a payment is due. You get your money on time, every time, without lifting a finger.

Benefit 3: You Deliver a Professional Client Experience

Instead of a dozen back-and-forth emails, the client gets a single, professional, branded online link. On one easy-to-use screen, they can review the proposal, e-sign the contract, and pay the deposit. It’s seamless, secure, and gives them confidence in your professionalism from the very first interaction. When the event is over, the final invoice is perfectly itemized, clear, and easy to understand.

Why Integrated Payments Create a Better Client Experience

Stop treating event payments as a side task. With integrated payments in event management, you connect your proposals, contracts, and collections into one seamless workflow. Tools like Tripleseat PartyPay don’t duplicate your POS—they amplify it.

Save time, reduce errors, and deliver a premium client experience from proposal to final invoice.

Learn more about integrated payments for event management with Tripleseat PartyPay today.